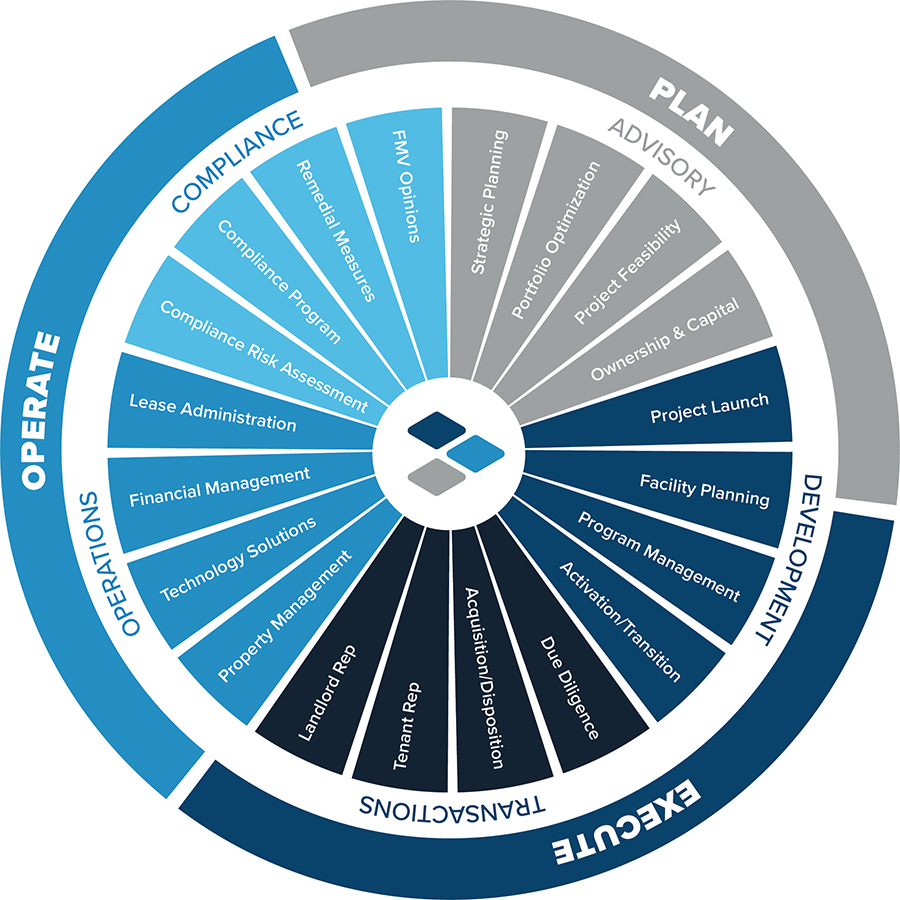

Transactions

Healthcare Real Estate Transaction Services

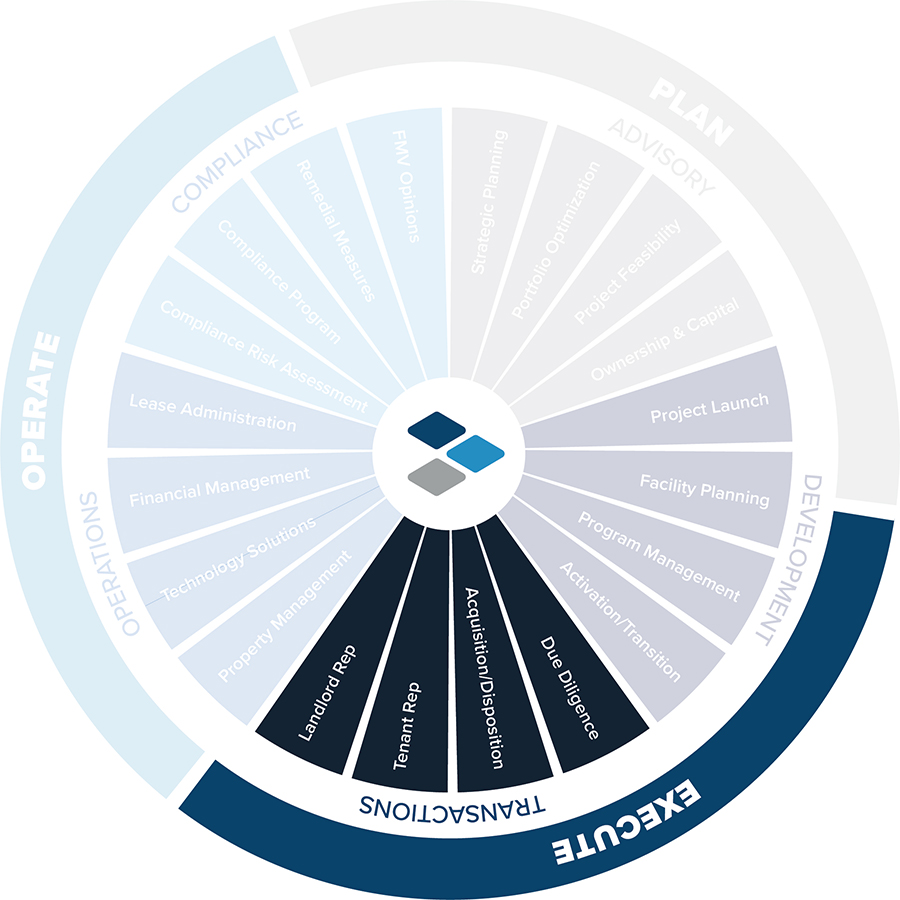

Realty Trust Group (RTG) provides highly experienced, independent, and objective representation for healthcare real estate transactions related to the acquisition or disposition of properties and landlord and tenant representation.

RTG has worked with numerous health systems, hospitals, and physician groups, each distinct in its way. We often find a common theme among our clients—an ongoing challenge to balance the tactical nature of transactions, or the “how,” with the overall strategy set by the client, or the “why” a transaction should be considered. These elements must be addressed while balancing healthcare compliance considerations. Precise management of healthcare real estate transactions aligns existing real estate assets and future real estate investments with the organization’s strategic, operational, and financial goals.

Due diligence is essential to ensure proper risk management when acquiring or disposing of a property or portfolio. There are physical, legal, and financial aspects to due diligence that must be completed within a short time frame. RTG has a team of experienced advisors to assist with these processes, mitigating risk and securing a successful healthcare real estate transaction.

Healthcare Transactions Services

Due Diligence

- Feasibility Analysis

- Zoning / Entitlement

- Physical Due Diligence

- Financial Due Diligence

Tenant Representation

- Market Survey

- Site Selection

- Financial Analysis

- Lease Negotiation

- Compliance Oversight

Acquisition/Disposition

- Asset Review

- Land / Building Transactions

- Investment Sales

- Portfolio Monetization

Landlord Representation

- Market Assessment

- Space Allocation & Management

- Leasing & Marketing

- Transaction Management

- Compliance Oversight

Healthcare Transactions Thought Leadership

White Paper: accessing capital though healthcare real estate

White Paper: accessing capital though healthcare real estate

Now more than ever, healthcare providers face growing demands for financial capital. Whether to fund ongoing operations, expansion initiatives, alignment opportunities, or technology investments, hospitals and physician groups must evaluate various capital sources to meet these needs. When properly structured, a strategic real estate recapitalization provides significant capital to fund key initiatives, improve liquidity and financial ratios, and support broader organizational goals.

In this white paper, RTG explores common strategies that healthcare providers use to unlock capital through real estate.

Best Practice: Key Considerations for Healthcare Real Estate Transaction Management

Best Practice: Key Considerations for Healthcare Real Estate Transaction Management

A failed real estate transaction can be a costly missed opportunity, while a successfully executed transaction can be a powerful enabler for health system strategy.

In this Best Practice Briefing, RTG offers key considerations to plan, manage, and successfully execute healthcare real estate transactions to maximize benefits and mitigate risks.